Signature solutions for your unique HR challenges

For those in the food service industry, ECCA Payroll+ can build the HR stack that has the solutions for the unique challenges restaurants face.

Point-of-Sales Integrations

With ECCA Payroll+, you can integrate many POS systems with your own HR stack. This eliminates the need for double-entry as time worked and tips collected is synced between the two systems.

FICA Tip Credit Report

You can easily track the matching portion of FICA paid on tips in excess of minimum wage. This report can save you money by enabling you to claim the FICA tip tax credit.

Minimum Wage Makeup

You can ensure your restaurant complies with federal and state minimum wage requirements by having an employee’s gross wage automatically increased if their pay and reported tips is lower than the required minimum.

Catered for your employees

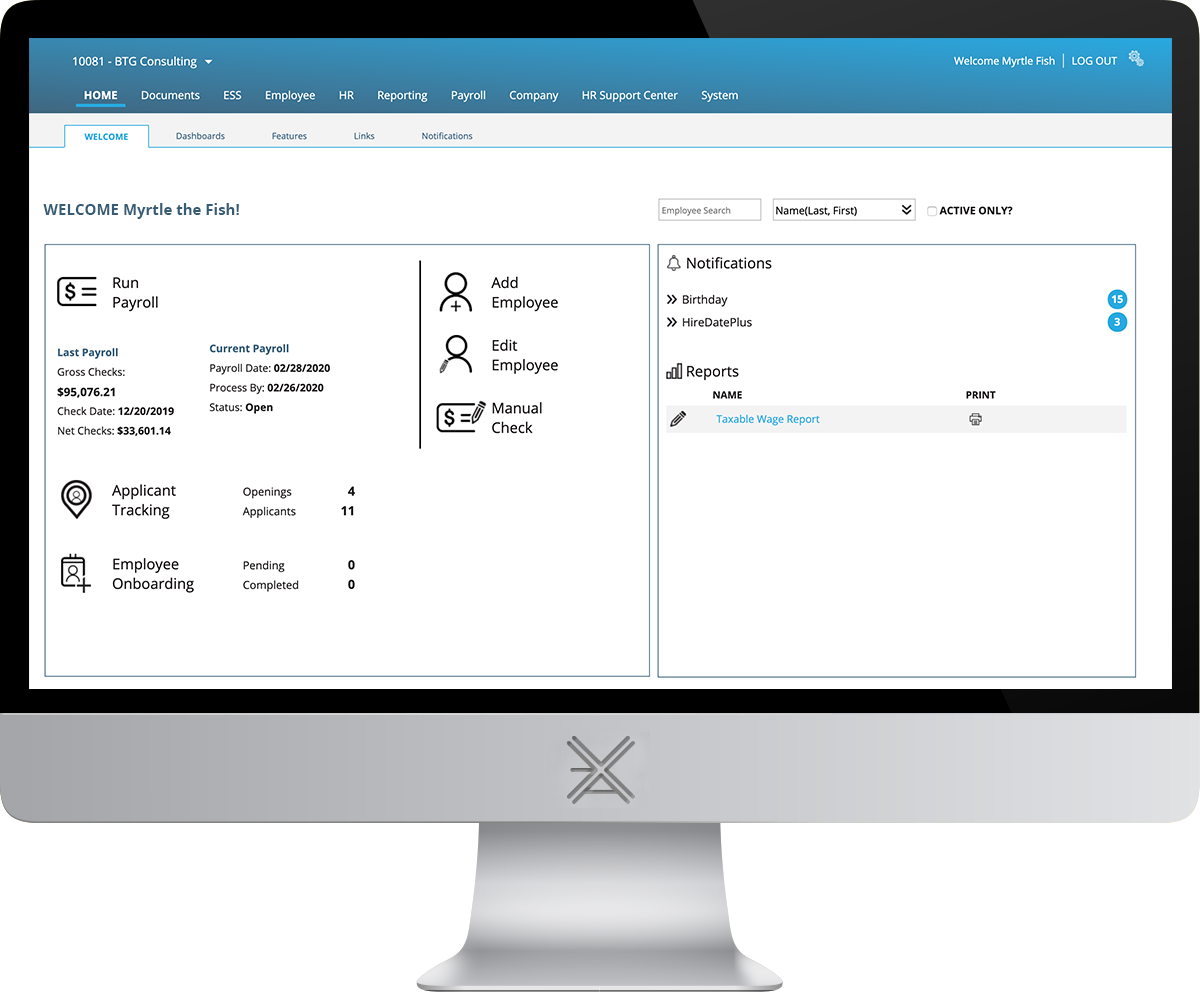

Take advantage of Applicant Tracking to overcome a traditionally high-turnover industry. As you find the best available staff for your establishment, you can easily welcome new employees without the need for re-entry thanks to the the customizable Employee Onboarding solution.

By onboarding your employees, you can screen new hires that potentially could be eligible for Work Opportunity Tax Credits (WOTC). With this key information in hand, you may be able to claim this federal tax credit.

Through integrations with many point-of-sale systems and reports on your employee’s tips, ECCA Payroll+ reduces the administrative burden of running your establishment. This allows you to focus your attention on where it should be – managing your kitchen and serving your customers.